A Guide to Nonprofit Accounting for Non-Accountants Bench Accounting

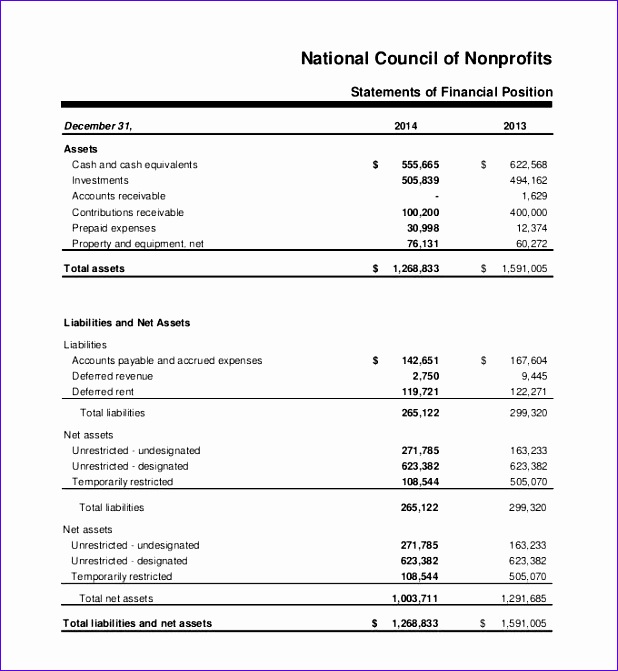

Regularly reviewing and understanding the balance sheet is essential for effective financial management in the nonprofit sector. Statement of Functional Expenses is a crucial financial document that provides detailed information on how a non-profit organization allocates its expenses. By categorizing expenses based on their functions, such as programs, administration, and fundraising, the statement helps stakeholders understand how resources are being utilized.

Free Course: Understanding Financial Statements

Our intuitive software automates the busywork with powerful tools and features designed to help you simplify your financial management and make informed business decisions. Donorbox is an affordable and simple-to-use online fundraising tool with powerful fundraising features such as Recurring Donations, Crowdfunding, Peer-to-Peer, Events, Memberships, and more. You can also manage donors, send them automated donation receipts, add offline donations, let donors login and manage their accounts themselves, and more on Donorbox.

Most Important Nonprofit Financial Documents

It helps assess the organization’s cash flow and its ability to meet its financial obligations. This is because those assets are tied up in physical belongings (property, software, etc.) and cannot be liquidated to cover additional liabilities. Then, divide this number by the average monthly expenses incurred by your organization. The result is the number of months that you can cover with the liquid assets you have on hand. In a nutshell, the liabilities section of your nonprofit statement of financial position sums up what your organization owes.

- Donors, grant-makers, and government entities all reserve the right to restrict the contributions made to nonprofits so that it can only be used for certain activities or programs.

- Nonprofits have a primary responsibility to the Internal Revenue Service (IRS) and their donors when filing and sharing financial statements.

- The nonprofit balance sheet is called a picture of your financial and non-financial resources.

- Complying with the generally accepted accounting principles (GAAP) will ensure that your nonprofit reports financial information accurately, transparently, and consistently.

- Now you know the basics of the five essential financial reports that every nonprofit needs.

Assets

Net assets on a balance sheet are crucial indicators of an organization’s financial health. They represent the difference between total assets and total liabilities, showing how much value the company actually owns. High net assets signal a strong financial position, while low net assets may indicate financial instability or debt concerns. If you’re looking for an easier way to get accurate and on-time financial reports, consider outsourcing your nonprofit bookkeeping and accounting to The Charity CFO. It is one of the essential financial statements that nonprofit founders need to know how to read.

We also highlighted the differences between nonprofit and for-profit financial statements. It is crucial for nonprofit organizations to prepare accurate and reliable financial statements to maintain trust and credibility. By following best practices and adhering to accounting standards, nonprofits can ensure transparency and demonstrate their commitment to their mission. Financial statements serve as a valuable tool for evaluating the financial performance and sustainability of nonprofit organizations. Nonprofit accounting involves recording and reporting financial information for organizations that do not operate to earn a profit.

Tackling taxes

When making decisions, it is important to consider all factors, including the information provided in the balance sheet. This financial statement provides a snapshot of a company’s financial position, allowing decision makers to assess the company’s liquidity and financial health. By analyzing the balance sheet, decision off balance sheet definition makers can make informed choices that are beneficial for the organization. When assessing the financial health of a nonprofit, it is important to look at both new financial and for-profit income statement. Financial analysis can be done by calculating financial ratios to determine the financial gain of the organization.

Keep in mind that your statement of financial position is a key document for the nonprofit auditing process. Whenever you pull the report, double and triple check the numbers to be sure they’re correct. That way, when it’s time for an audit, you’ll know you’re giving them the most accurate information possible. Current liabilities are obligations that a company must pay within one year, typically including accounts payable, short-term loans, and accrued expenses. These are listed on the balance sheet and can affect a company’s liquidity and financial health if not managed properly. Failure to meet these obligations can result in financial difficulties or even bankruptcy.

Functional areas of the organization often include programs, fundraising, and management. The expenses listed in this statement are broken down further into exact expenses, including salaries, events, and administrative costs. • Change in Net Assets This is your nonprofit’s “bottom line.” In the for-profit world, they call the difference between revenues and expenses net income (or profit). But a nonprofit calls the difference between revenue and expenses change in net assets. Understanding a nonprofit’s net assets is pivotal to both short- and long-term planning.

Sin Comentarios

Lo siento, el formulario para comentarios está cerrado en éste momento,